The deadline to contribute to your IRA for a tax year is usually your tax return due date. In most cases, that’s April 15. For 2019, however, the tax-filing deadline has been extended until July 15, 2020, as part of the Coronavirus tax relief. This means you have extra time to make an IRA contribution for 2019. If you meet the eligibility requirements (explained below), you can contribute up to $6,000 to your traditional and Roth IRAs for 2019 ($7,000 if you’re age 50 or older).

Contributions to a traditional IRA can lower your tax liability for 2019. You may be able to double your tax deduction if you’re married and your spouse also contributes to an IRA. Even if only one of you has earned income, you may still fully fund two IRAs if you are married and file a joint federal tax return – an opportunity to build retirement savings for both spouses when only one spouse has significant income.

Rules for 2019 Contributions to a Traditional IRA

Eligibility: If you have earned income to support your contribution and are younger than age 70½, you are eligible to contribute to a traditional IRA for 2019. (Hint: this changes for 2020)

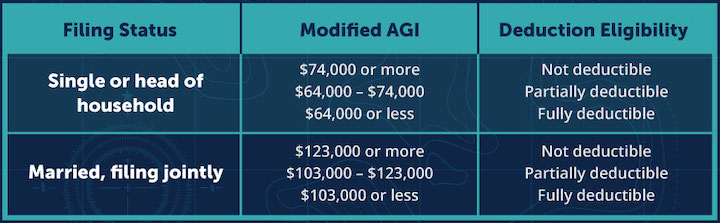

Deductibility: If you (and your spouse) do not participate in a workplace retirement plan, your traditional IRA contribution will be entirely tax-deductible. If you participate in a retirement plan, your modified adjusted gross income (AGI) must fall within the following ranges to be eligible for a deduction.

If you do not participate in an employer’s retirement plan but your spouse does, your phase-out range for determining deductibility is $193,000 – $203,000.

If your modified AGI exceeds the limits for being eligible to take a deduction, you are still eligible to contribute to a traditional IRA; you just won’t get a tax break for contributing in 2019. But you will be able to withdraw your nondeductible contributions (excluding earnings) tax free from the IRA. This can help build your reservoir of nontaxable retirement income.

Rules for 2019 Contributions to a Roth IRA

You may be eligible to make a Roth IRA contribution in addition to or instead of a traditional IRA contribution for 2019.

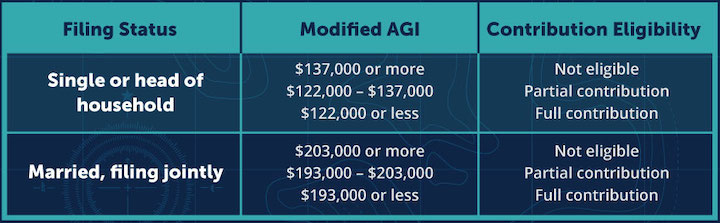

Eligibility: Your must have earned income to support your contribution, and your modified AGI must fall below a certain level to be eligible to make a Roth IRA contribution.

Deductibility: Roth IRA contributions are never tax deductible, but they are always distributed tax-free from the Roth IRA. Investments earnings may also be distributed tax-free in a qualified distribution.

Changes for 2020 IRA Contributions

The SECURE Act, which was passed into law at the end of 2019, changes the traditional IRA eligibility rules, beginning with the 2020 tax year.

Rules for 2020 Contributions to a Traditional IRA

Eligibility: Beginning in 2020, there is no age limit for making traditional IRA contributions. To be eligible to contribute, you just need to have enough earned income to support your contribution. Even if you must start taking required minimum distributions (RMDs) from your traditional IRA in 2020, you may still make contributions if you have earned income.

Deductibility: The deductibility rules remain the same for 2020, but the modified AGI ranges increase slightly. If you are age 70½ or older and take a deduction for your IRA contributions, the dollar amount you may count as a Qualified Charitable Distribution (QCD) IRA will be reduced.

If you do not participate in an employer’s retirement plan but are married to someone who does, your phase-out range for determining deductibility is $196,000 – $206,000.

Rules for 2020 Contributions to a Roth IRA

Eligibility: There are no changes to the rules for contributing to a Roth IRA for 2020, except an increase in the modified AGI limits.

To learn more about IRA contributions