Currently, we are in the midst of one of the longest stock-market runs ever with many experts predicting that an economic downturn is long overdue.

This overvaluation and uncertainty in the market has many investors opting-out of the traditional stock market, with its high fees and volatility, focusing instead on physical assets which produce real returns. While, there are many alternatives self-directed IRA investors can turn to, our guest post today focuses on multifamily real estate market.

Will Multi-family be a Safe Haven in Turbulent Markets?

Real estate investing has been a staple of many wealthy investors’ portfolios for years. Morgan Stanley’s 2014 Millionaire Investor Survey reports a 35% rate of real estate related investments among their millionaire clients.[1]

Investors tend to love this asset class, because it produces real income, and has less volatility than nearly any other market.

|

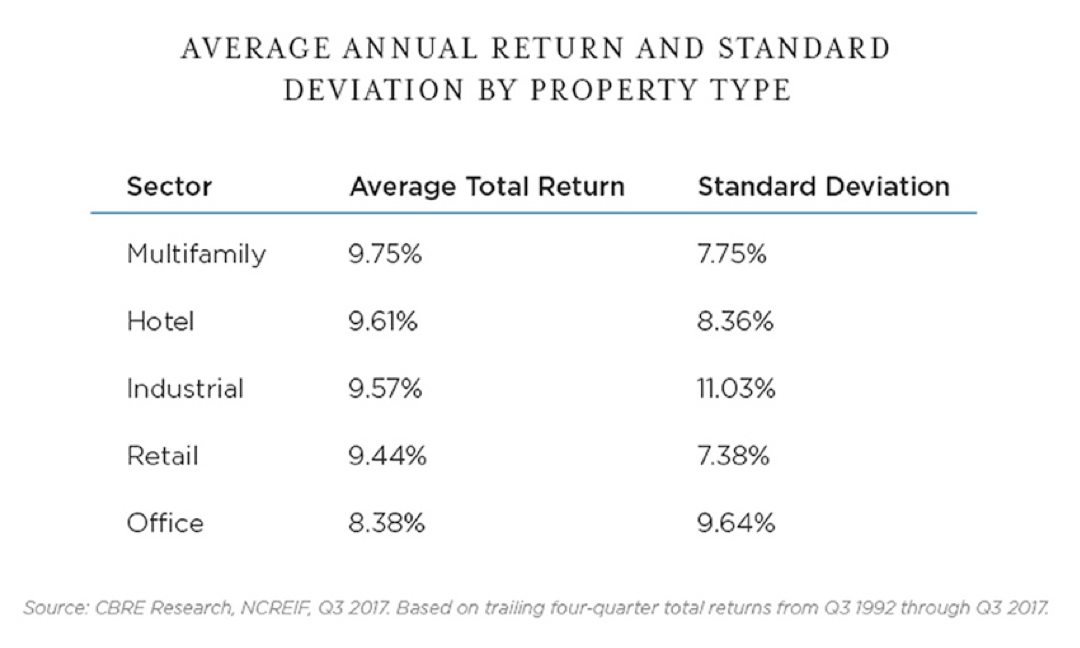

A 2018 report by CBRE, the world’s largest commercial real estate firm, reported that multifamily real estate had average returns of 9.75% and a total volatility of 7.75% over the last 25 years. By contrast, large cap stocks have an average volatility of 16%. Multifamily produces the highest return of any other real estate asset class.

At Upside Avenue, we have a long track record of success within the multifamily real estate markets, producing an average return of over 33% throughout our 16 years investing over $1.2 billion within the multifamily markets. While past performance is no guarantee of future results, we believe the multifamily has a great deal of value remaining.

|

|

In recent years, tax law changes and demographic shifts have been affecting the real and perceived value of homeownership.

These shifts have created pent-up demand in the rental markets. Over 4.6 million new rental units (350,000 per year) are needed by 2030 to meet projected demand. While average deliveries over the last four years were 244,000.

2017 Tax Bill on Real Estate

Recently, the tax benefits of investing in the commercial real estate industry were intensified by the 2017 tax bill on real estate. Historically, the favorable tax treatment of mortgage interest was a huge benefit of homeownership, but a negative consequence of the tax bill was a reduction in the impact of the mortgage interest benefit for single-family homeownership. The National Realtors association stated, “Congress has greatly reduced the value of the mortgage interest and property tax deductions as tax incentives for homeownership.” Congressional estimates indicate that only 5-8% of tax filers will now be eligible to claim these deductions by itemizing, meaning there will be no difference between renting and owning for the large majority of people, from a tax standpoint.

This has slowly played out in the market where Census Bureau figures show that in the second quarter of 2016, the overall homeownership rate dropped to 62.9 percent—a record low in more than 50 years. By 2025, this number is expected to decline further to 60.8 percent – the lowest level since the 1950’s. These record lows, paired with other demographic shifts will inevitably have an effect on the investment value and demand of multifamily real estate.

Renter Population Growth

The renter population is expected to grow significantly from now through 2041. The Urban Land Institute projects that the next wave in residential growth is expected over the next ten years as millennials enter into adulthood. During this time, it’s expected that there will be an 86 percent increase in new household formations, totaling roughly 12.5 million households. From this group, 58 percent are expected to be renters.

The Rise of Renting Millennials

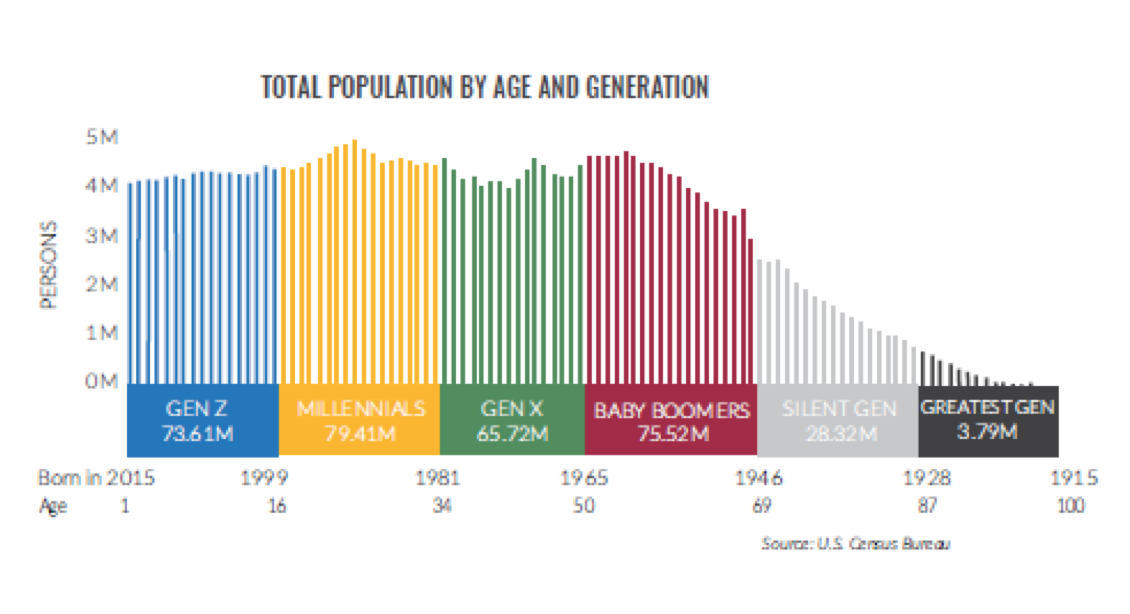

With 92 million people, the millennial generation is the biggest in U.S. history—even bigger than the Baby Boomers. The factors that influence millennials to choose renting over homeownership are:

Home affordability is at an all-time low.

They average $42,000 in student loan and credit card debt, according to Northwestern Mutual's 2018 Planning & Progress Study.

Delaying marriage and are not having families at the same rate as other cohorts.

They want to live in urban centers close to amenities.

They are willing to live in smaller spaces.

They value flexibility, and still feel the pain of the housing collapse.

Additionally, the Generation Z population, with just 1.9 million fewer people than the massive Baby Boomers have just begun to enter the rental and student housing market. This massive influx of new renters will only continue to increase the demand within multifamily markets.

Boomers Exit Suburbia

|

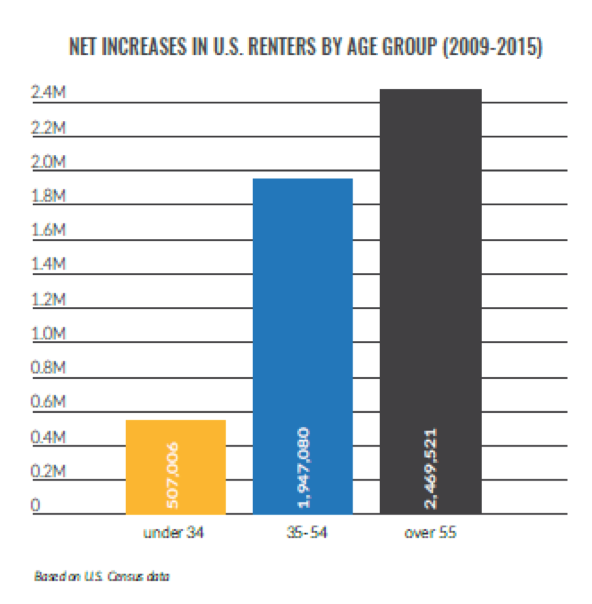

While Millennials will be primarily responsible for the spike in renters in the future, an underlying theme reported by the 2015 census report is that baby boomers are becoming the fastest growing renter demographic in the country.

More than 5 million baby boomers are expected to rent their next residence by 2021. Many sources report that baby boomers are opting for upscale, amenity-rich, multifamily rentals in urban neighborhoods which promise flexibility, cultural vibrancy, and a newfound sense of community in apartment homes.

|

|

At Upside Avenue, we believe in investing on long-term market growth, paired with a focus on investing in investment properties that produce real income. We often only look at assets that produce above an 8% cash-on-cash with total returns to investors (after the sale of the assets) in the mid-teens. This leads us to invest in B and C class assets that typically are 15- 40 years old, in working-class areas of the Sun Belt regions of the U.S. We also avoid heavy investment in new construction, which can come with lease-up risks.

With markets at their peak, investing based on long-term trends and in cash-flow positive assets can provide self-directed IRA investors with both a market hedge as well as income and long-term growth.

Yuen Yung, CMFC and CFP® serves as CEO of Upside Avenue, an income-focused REIT investing in apartments, senior housing and student housing which is open to all investors throughout the globe. Yuen is a seasoned real estate and financial professional who spent over a decade in the investment management industry.

[1] Morgan Stanley’s 2014 Millionaire Investor Survey

*Mainstar's role as custodian of self-directed accounts is nondiscretionary and/or administrative in nature. This information is for educational purposes only, and should not be construed as investment, legal, tax or financial advice or as a guarantee, endorsement, or certification of any investments. Mainstar encourages individuals to consult a financial or legal professional when making investment decisions.